Exclusive | Shell in Early Talks to Acquire Rival BP

Shell Denies BP Takeover Talks, Market Reacts

Key Takeaways

💬 Shell denies talks: Shell officially stated no current takeover discussions with BP, calling reports "market speculation" .

📈 BP stock volatility: BP shares surged 10% on initial reports, then pared gains to +2% after Shell’s denial .

🔥 BP’s struggles: 23% stock decline over the past year, activist pressure, and failed green strategy made BP a rumored takeover target .

⚖️ Regulatory hurdles: A merger would face intense antitrust scrutiny—the largest attempted in energy since Exxon-Chevron COVID-era talks .

🧩 Breakup possibility: Analysts suggest BP might be split and sold piecemeal if a deal advances .

Breaking Down Shell’s Rumored Bid for BP

The Initial Report and Swift Denial

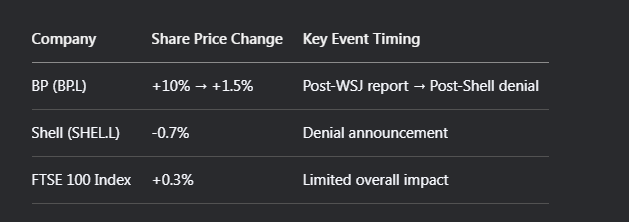

Wall Street Journal dropped a bombshell yesterday: Shell was in early talks to buy rival BP in what could’ve been one of the largest oil mergers ever. Word spread fast, and BP’s stock shot up 10% almost immediately in New York trading . But within hours, Shell slammed the brakes. Their spokesperson called it “further market speculation” and flatly stated, “No talks are taking place” .

Shell CEO Wael Sawan’s been consistent here. He’s said for months that share buybacks beat big acquisitions. Buying BP? That bar’s “very high,” he’d hinted before . Still, the denial didn’t explicitly say talks hadn’t happened earlier. Markets noticed that gap, and BP shares held onto a slim 1.5% gain by close .

Table: Immediate Market Reaction

Why Markets Took the Rumor Seriously

BP’s been struggling, no secret there. Their shares tanked 23% over the past year while Shell gained 8% . CEO Murray Auchincloss’s February “reset”—ditching green investments for more oil and gas—landed poorly. Investors stayed skeptical, and activist fund Elliott Management pounced, grabbing a 5% stake demanding fixes .

Numbers tell part of the story: BP’s market value sits near $80 billion, with $27 billion net debt. Shell? A healthier $208 billion valuation . That gap made BP look cheap, but analysts note hidden costs—like untangling its messy transition strategy—might bump real takeover costs higher .

Shell’s Position: Discipline Over Deals

Sawan’s not playing around. His focus is “performance, discipline and simplification” . Translation: no splashy buys. Shell’s printing cash with oil near $80/barrel, and they’re funneling it back to shareholders via buybacks. Just last quarter, they returned $3.5 billion .

Acquiring BP would mean swallowing $27 billion in net debt, plus regulatory headaches. Sawan’s team seems to think that’s not worth the squeeze when their own stock’s doing fine . “Buying back Shell shares [...] continues to be absolutely the right alternative,” he told the Financial Times earlier this year .

Regulatory Hurdles: Could This Even Fly?

Imagine Shell and BP merging. You’d get a colossus controlling huge chunks of UK energy, US shale, and global LNG markets. Regulators wouldn’t just nod yes. In fact, no oil major’s tried a buy this big since Exxon and Chevron flirted briefly during COVID’s chaos .

Antitrust reviews would drag on for months, maybe years. Governments would demand asset sales—especially in overlapping regions like the North Sea or Gulf of Mexico. And political heat? Huge. Both firms face climate lawsuits already; merging would draw even more fire from green groups .

The Breakup Scenario

CNBC’s sources hinted at another path: breaking BP up . Think piecemeal sales—US shale to ConocoPhillips, UK assets to Harbour Energy, renewables maybe to TotalEnergies. Elliott Management likely prefers this. They’ve pushed BP to unlock value, and a full buyout isn’t the only exit .

BP’s LNG portfolio could tempt Shell, sure. But taking the whole company? Messy. Shell might bid for bits if BP gets carved up later. For now though, Shell’s playing it quiet .

Leadership Chaos at BP

Remember Bernard Looney? BP’s ex-CEO quit last year over hidden relationships with staff. His big green vision—cut oil output 40% by 2030—collapsed when Ukraine war spiked energy prices. BP backtracked, but investors fled .

Current CEO Auchincloss hasn’t steadied things. His pivot back to fossil fuels—slashing $4 billion from clean energy budgets—hasn’t boosted shares. Chair Helge Lund bailed in April under shareholder pressure . With no clear strategy, BP looks adrift. Perfect takeover bait, rumors or not .

Table: Financial Snapshot (June 25, 2025)

What’s Next for Both Companies

Shell stays the course. More buybacks, maybe small asset tweaks. Sawan’s betting that simplicity wins .

BP? Pressure’s mounting. Elliott won’t wait forever. If Auchincloss’s production push fails by Q3, breakup calls will grow louder. Shareholders might even force a sale—not necessarily to Shell, but to whoever bids highest for the pieces .

Meanwhile, oil prices loom over both. If crude dips below $70, BP’s cash flow crumbles. That could make it truly cheap enough for Shell—or others—to pounce. But for now, Shell says no. Markets half-believe it .

Frequently Asked Questions

Are Shell and BP still in merger talks?

No. Shell stated clearly on June 25, 2025, that “no talks are taking place” regarding a BP takeover. They dismissed reports as “market speculation” .

Why did BP stock jump so high?

BP shares surged 10% initially on the WSJ report of takeover talks. Investors saw a potential premium bid. Gains shrank to +1.5% after Shell’s denial, but some held hoping talks might resume .

How would a Shell-BP merger affect the oil industry?

It’d create the largest oil company since Exxon-Chevron’s failed COVID-era talks. Prices could rise in regions where they overlap (like Europe), and rivals might rush to consolidate .

Who wants BP to break up?

Activist investor Elliott Management—holding over 5% of BP—is pushing for value creation. Analysts suggest a breakup could unlock more cash than selling the whole company .

Is BP really cheaper than Shell?

On paper, yes. BP’s market cap is ~$80B vs. Shell’s $208B. But BP carries $27B net debt, and its messy strategy means integration costs could erase any “bargain” .